Crypto Finance

Lessons from the 2020 Crypto Market Performance

With all the issues that occurred this year (COVID-19, an economic crisis, etc.) one could find it impressive that cryptocurrencies managed to have such an impressive performance. However, we must embrace reality as it is and also, try to take out the most important lessons from it. That’s exactly what we want to do today as we will talk about the top 4 lessons we’ve learned from this year’s crypto market performance.

#1 The majority is still always wrong

Back in March, we saw a rapid selloff in most cryptocurrencies, with Bitcoin losing around 50% of its value within days. All crypto experts were already predicting that the bear market will continue to extend due to a depressed risk appetite. Still, the market was already extremely oversold and the exact opposite had happened, with Bitcoin now trading close to the 2019 highs. Having a contrarian approach when markets are overstretched continues to be one of the best ways to take advantage of attractive valuations.

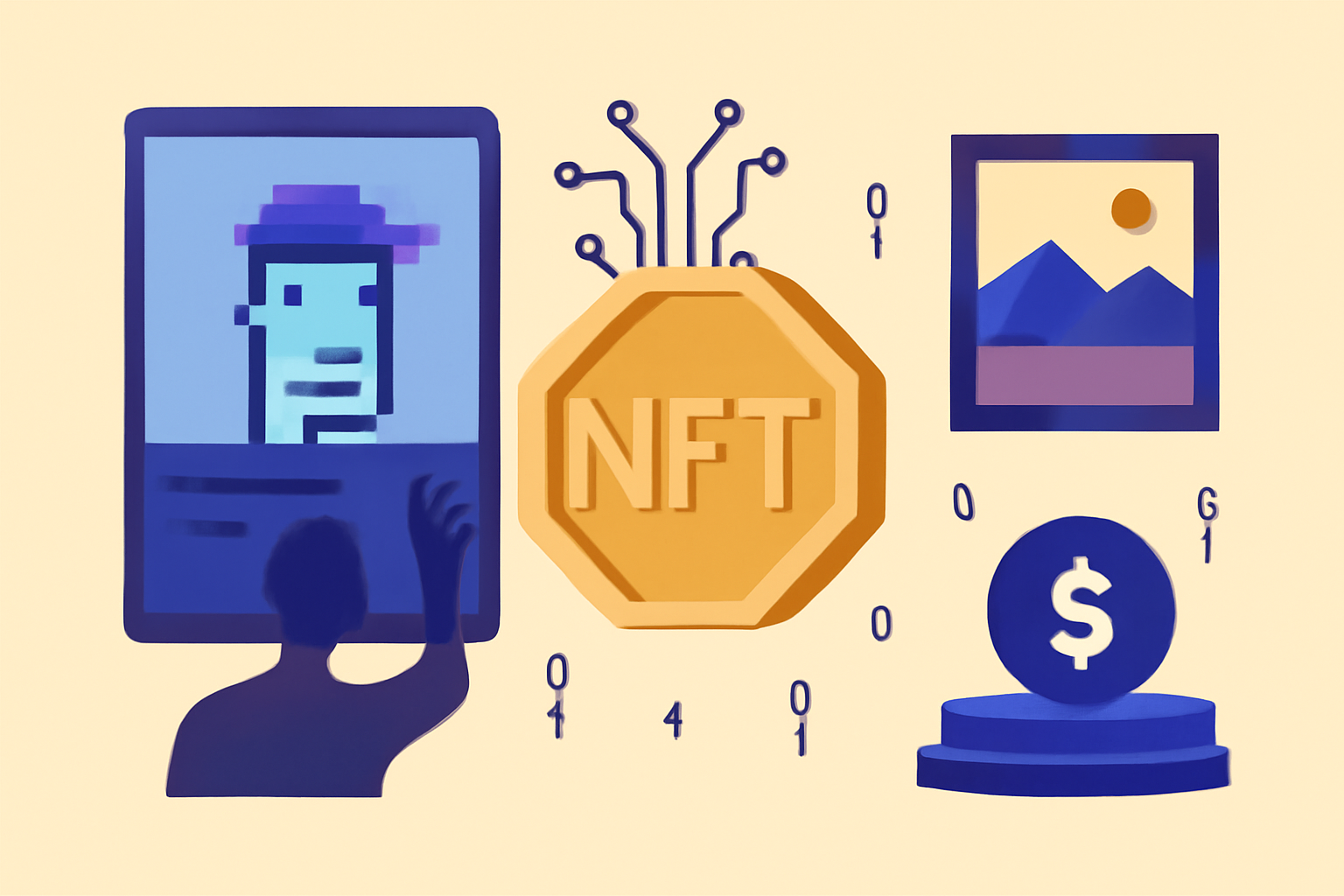

#2 Investors are accumulating in “hot” tokens

In 2017, the entire cryptocurrency market was in sync, with cryptocurrencies rising and falling together. The investors’ mindset had changed since then and now they are focusing on the tokens that are trending. During this summer we’ve had the DeFi bubble then it burst. Now Bitcoin is very active and could reach levels not seen since the beginning of January 2018 in a few days. We don’t know how long that could last and what tokens will come under the spotlight, but it is obvious market participants are jumping from a basket of tokens to another.

#3 Crypto has an edge against fiat debasement

The world is facing the biggest economic setback since WWII and because of that, fiscal and monetary support will continue to be aggressive. This generally leads to fiat debasement and in return asset price appreciation. In this type of environment, cryptocurrencies have a clear edge, considering they come with a fixed supply, so we should expect their valuation to increase, denominated in fiat.

#4 Flexibility remains one of the key skills

This had been and continues to be a wild market. Anything can happen and because of that, we need to keep a flexible mindset. Despite security concerns and the room left for development, blockchain and cryptocurrencies will continue to be attractive investments in the years ahead. For those able to manage the risk, this should be one A lot of new surprises and opportunities lie on the horizon, but we need to prepared for them.