Cryptocurrency

Particularities of Risk Sentiment in the Crypto Market

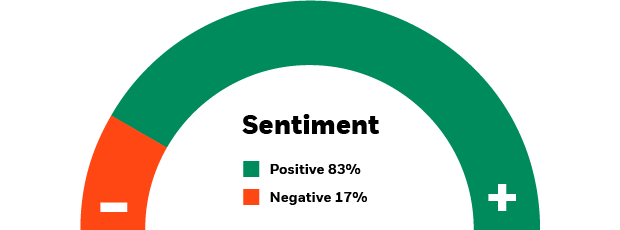

The market sentiment is one of the most important pillars of cryptocurrency trading, with both traders and investors monitoring carefully how it evolves over time. However, if we put cryptocurrencies alongside other asset classes (stocks, commodities, currencies, etc.) the conclusion is that there are a few important differences when it comes to how risk sentiment fluctuates.

#1 Speculation

One of the most important variables we must take into account has to do with the speculative nature of cryptocurrencies. At the present time, we don’t have worldwide usage of cryptocurrencies and the industry is still in its early stages. The industry has a lot to grow, but until digital money will be part of our lives, cryptocurrencies will only be speculative instruments, with large fluctuations over any given period of time. In this case, long-term investors find themselves in a very tricky position, since it will be difficult to assess whether a certain valuation is the appropriate one.

#2 Market manipulation

Whether we like it or not, market manipulation techniques can thrive in a low-regulated market. Wash trading, spoofing, short-squeeze, or pump-and-dump are just a few of the manipulations that repeat themselves over and over in this market. There’s nothing we can do about them since the market will change over time, but we must take into account how the risk sentiment is influenced at any point, in order to buy/sell cryptocurrencies at the optimal price.

#3 Fast-changing fundamentals

Technology is one of the fast-changing industries and sits at the core of the whole concept of cryptocurrencies. Any new developments could help certain projects or destroy others. As a result, the market sentiment will always be vulnerable in the face of any sudden change in fundamentals. Long-term cryptocurrency investments are not a suitable approach, given how fragile any cryptocurrency seems in the face of technological progress. Investors will need to be constantly updated with all the latest market development and at the same time, manage to anticipate how the valuations will be affected.

Summary

Based on all the aspects discussed, we can conclude that cryptocurrency risk sentiment continues to be very volatile. However, speculation is the right way to approach the market and it can help us find turning points in the market. What we can be sure of is that a lot of things will change and we can’t be sure whether all cryptocurrencies, currently in existence, will manage to survive. In order to navigate the market, a short-term approach is the best-suited, unless you are someone who managed to buy from a very early stage.