Cryptocurrency

Downsides of Using Elliot Wave for Crypto Trading

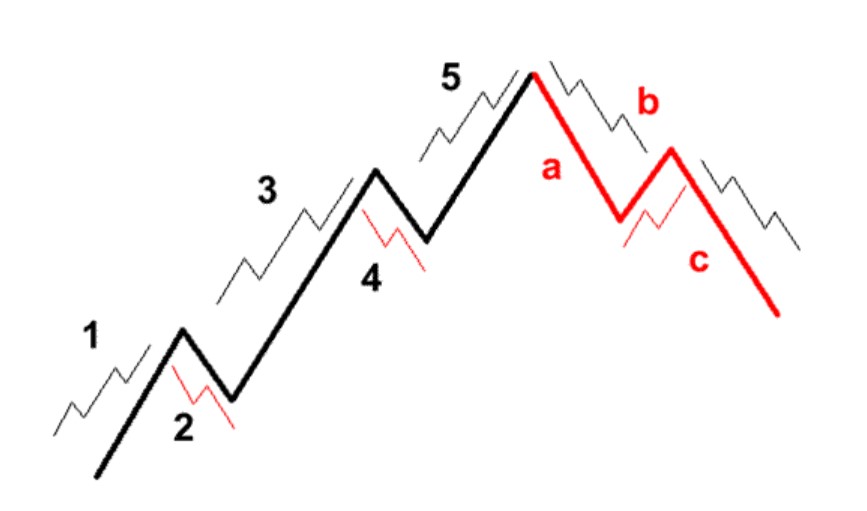

Technical analysis strategies are trending among cryptocurrency traders and that’s something normal, considering crypto valuations are determined the same as any other financial assets. Past price performance shows many important details about the underlying order low and based on it, we can have a better picture of how the majority of market participants are placing orders. However, not all technical analysis strategies are suited, which is why we want to talk about the downsides of using Elliot Waves.

# Limited flexibility

With the risk of creating some negative feedback from some of our viewers that are fans of Elliot Wave, we think several important aspects need to be considered, given the cryptocurrency market has some unique qualities. One of the first reasons why using Elliot Wave could be a low-accuracy strategy when trading crypto has to do with its limited flexibility.

Valuations are driven by emotions these days and at any point, the market can make an unexpected turn. Traders must act fast and adjust positions, but in the case of Elliot Wave, if you think the 3rd or 5th wave of the series did not end yet, you should stick to the rule and keep the trade open.

# Price manipulation on exchange platforms

Second of all, cryptocurrency brokers are using valuations from exchange platforms, and as previously-talked, there are still multiple ways exchanges can manipulate prices, making the price action irrelevant for a fixed-rule system like Elliot Wave. This will apply mostly when it comes to trading small altcoins, where liquidity conditions are poor, and the likelihood of price manipulation increases.

Until cryptocurrency exchange platforms will be fully regulated and their activity under supervision, we should expect to see pump-and-dumps, FOMO, or FUD, to alter market valuations, regardless of whether any given technical analysis strategy will indicate the opposite.

# Subjectivity

Ultimately, there is a lot of subjectivity involved in using Elliot Wave. Especially when trading crypto corrective structures, there could be a lot of debate on where a certain wave started or ended. This means it would be important to only use this charting method only when the price has a clear directional bias, and you can separate consolidation areas from impulsive moves.

The subjectivity bias is something to take into account and traders will need to always question their ideas, in case their market expectations start to be incorrect. To conclude, we believe it would be better to avoid Elliot Wave when trading crypto, but in case you have years of experience with it, maybe you could integrate this method into a particular price action context. What are your thoughts on Elliot Wave and do you think it can be used for crypto trading?