Bitcoin

3 Signs a Cryptocurrency Investment Program Is a Ponzi Scheme

In recent years, there has been a sharp surge in the number of Ponzi schemes tied with the virtual currency market’s uptrend.

Hence, it is significant for cryptocurrency investors to learn about how to spot a Ponzi investment scam. We want to safeguard our readers who are cryptocurrency investors in their investing journeys.

We believe this educational article about discovering if a cryptocurrency investment program is a Ponzi scheme will be helpful for them, so we are sharing it on our website.

Based on the informative online discussion posted on the Internet by Investing.com, a website delivering the latest finance updates and offering streaming charts, investment portfolios, live stock market data, and free real-time quotes, the cryptocurrency field has encountered a rise in Ponzi schemes since 2016.

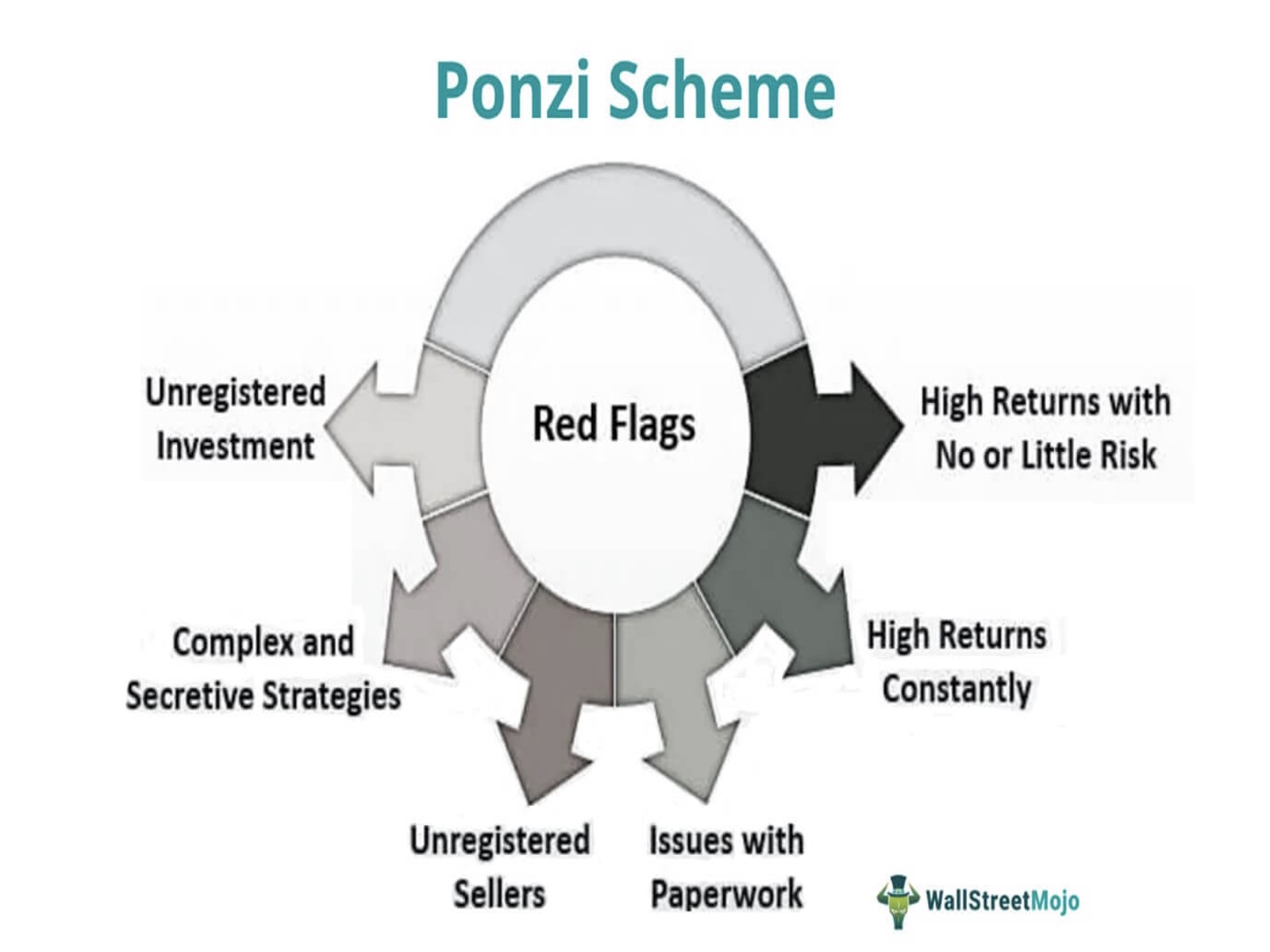

That year was when the virtual currency market gained mainstream prominence. A Ponzi scheme is a bogus investment program.

This phrase emerged in 1920 when a fraudster named Charles Ponzi marketed a high-return investment program to investors who allegedly leveraged postal reply coupons to achieve impressive investment earnings.

Ponzi guaranteed investors returns of up to 100 percent interest within 90 days and 50 percent within 45 days. He was true to his word with the initial group of investors receiving the claimed returns.

However, they were unaware that the money they earned was actually from later investors. This cycle was made to entice new investors and enabled Ponzi to steal more than US$20 million.

Considering the following three features of a cryptocurrency investment program can help investors know if they are investing in a Ponzi scheme:

A. The swindler promises an unwitting investor with ridiculously high investment returns.

Typical virtual currency investments fluctuate based on prevailing market conditions. However, a cryptocurrency Ponzi scheme normally claims to reward investors with hefty investment returns with minimal risk.

This fraudulent setup contradicts how legal investing works in the real world. In reality, a certain amount of risk entails every investment program.

B. The Ponzi scammer is engaged in multilevel marketing.

Multilevel marketing is a controversial merchandising method. This complex earning scheme requires participants to generate revenues by recruiting people to join the network and selling certain services and products.

Recruits earn commissions that are shared with the up-line members. Besides the referral programs, percentages, and multiple user tiers, multilevel marketing involves other tricks like sliding scales.

These features are all Ponzi scheme signs. They feed the upper tiers with the money the lower tiers injected without actually performing any business.

C. The cryptocurrency investment project is unregistered with a regulatory organization.

Investors should avoid virtual currency investment projects registered in locations with lax crypto-asset regulations.

These scams usually have Ponzi scheme-like characteristics. Investors should remember that legal cryptocurrency companies are typically registered with government regulators.

They are compliant with the monitoring authorities, keeping the latter aware of their revenue models. Therefore, these legitimate virtual currency investment firms are unlikely to participate in Ponzi schemes.

We urge our readers to study and keep the abovementioned features of a cryptocurrency Ponzi scheme in mind. In this manner, we believe they can always stay protected in their investment journeys.