broker review

eXcentral Review

General Information

eXcentral is a brokerage brand owned by Mount Nico Corp Ltd., specializing in providing access to a diversified list of tradable instruments, including several cryptocurrencies. The main benefit when trading with this provider comes from its regulatory compliance, since eXcentral is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC).

On top of that, the brand is compliant with all the latest European regulations for CFD trading, ensuring strong security and transparent services, and constantly keeping a customer-centric approach.

With eXcentral you can trade FX, shares, indices, and commodities as well, yet our focus today will be on cryptocurrencies and some of the main benefits when working with this brand. Regardless if you are already working with a broker, or currently looking for one, this eXcentral Review can help you make a better, more informed decision.

Services and Cryptocurrencies Supported

The services provided are for retail CFD traders and cover a broad spectrum of benefits. Customers can choose from 4 different account types (Classic, Silver, Gold, and VIP), each with a unique set of features, including better spreads, eXcentral interactive courses, and other educational resources.

In terms of trading software, MetaTrader 4 and a proprietary WebTrader are two choices promising fast execution, a user-friendly interface, and enough tools to deal with the challenges of the cryptocurrency market.

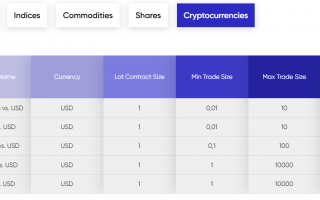

When opening an account with eXcentral, you get access to the following crypto instruments:

- BCHUSD

- BTCUSD

- ETHUSD

- LTCUSD

- XRPUSD

With leverages ranging between 1:2 (retail) and 1:5 (professional), flexible trading costs, and very low minimum trade sizes, eXcentral wants all its customers to have access to crypto trading. The main benefit is that you can integrate crypto instruments into an already-established portfolio, to make sure you have diversified exposure to the market.

eXcentral covers the top 5 most traded cryptocurrencies in the world and that means better liquidity, accurate pricing, and execution.

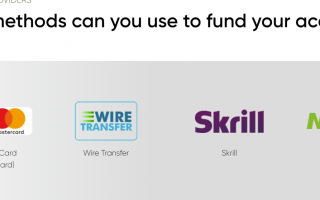

Funding Methods and Trading Costs

Funding an account can be done using a credit/debit card, a wire transfer, Skrill, or Neteller. The broker does not charge deposit fees and the minimum amount, regardless of the method used, is 250 units (in EUR, USD, or GBP).

The method used for the deposit is going to also be the main withdrawal channel later on. In this case, however, there are fees involved. On top of that, each customer needs to verify their identity and residence, in line with the latest regulatory requirements.

Trading costs when trading crypto with eXcentral come in the form of spreads and overnight swaps. There are no trading commissions charged when trading on any of the cryptocurrency CFDs covered. A fee that should be kept in mind is the inactivity fee. It is automatically charged in case there is no activity on a trading account for more than 30 days.

There are no trading costs associated with custody or blockchain fees since eXcentral traders buy or sell CFDs based on cryptocurrencies without holding the underlying assets.

Customer Support

No concessions are made when it comes to customer support services. eXcentral hires a large team of expert advisors, available during working days via live chat, email, or phone. Based on existing online reviews, the customer-oriented approach is obvious, as the broker does its best to meet the demands of its audience. Gold and VIP account holders also benefit from support provided by dedicated account managers.

Geographical Restrictions

With headquarters in Cyprus, eXcentral is a brokerage house focused on countries in the European Economic Area. Keep in mind that it does not accept customers from the Netherlands. Also, cryptocurrency assets are unavailable to UK residents excluding registered professional traders. Other major restricted jurisdictions are the USA, Canada, and Japan. The trading offer is tailored in accordance with the latest European regulations for CFD trading and thus customers benefit from retail or professional trading conditions, depending on whether they’re able to meet the requirements.

Summary

Due to its regulatory compliance, professional trading approach, and trading environment optimized for the past three years, eXcentral proves to be one of the brokers to consider, especially for traders who would like to get involved in some of the most popular crypto CFDs.

It is important to note that with eXcentral, the trading offer is not limited just to cryptocurrencies and this means customers can diversify with other leading asset classes. Trading crypto with this provider is safe, and transparent, and can be performed using a multitude of tools, some of them integrated into the trading platforms available. We conclude that eXcentral is a leading trading brand, relying on a solid reputation.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79.65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read our Risk Disclosure document.