broker review

Ex-Cap Review – A Global Broker Offering Crypto-Denominated Instruments

What is Ex-Cap?

Ex-Cap is a retail broker which seems to have an innovative approach – the kind that is oriented towards crypto enthusiasts. When you hold an account with this brand, you can gain exposure to hundreds of crypto-denominated instruments. That’s a good sign, now that there are so many people who are storing their savings in crypto.

This is the reason why this regulated broker caught our eye. Just like with many other brands that we’ve covered so far, it was important for us to conduct this thorough broker review in order to truly understand what it offers. Read this Ex-Cap review to find out more.

CDI trading

With CDIs (crypto-denominated instruments) you have several advantages. The list of covered tokenized assets is quite wide and versatile. Ex-Cap offers access to tokenized currencies, metals, indices, shares, crypto and energy. The only difference is that the price of these instruments is quoted in crypto, and you can use your crypto to buy and sell derivatives of these assets.

Trading accounts are denominated in stablecoins and on top of that, if you want to trade crypto, there’s an extensive range of tokens that are part of the asset index. But the big advantage here is that you can diversify. In other words, if you want, tokenized forex and crypto can be blended with ease (alongside other CDIs).

Types of accounts

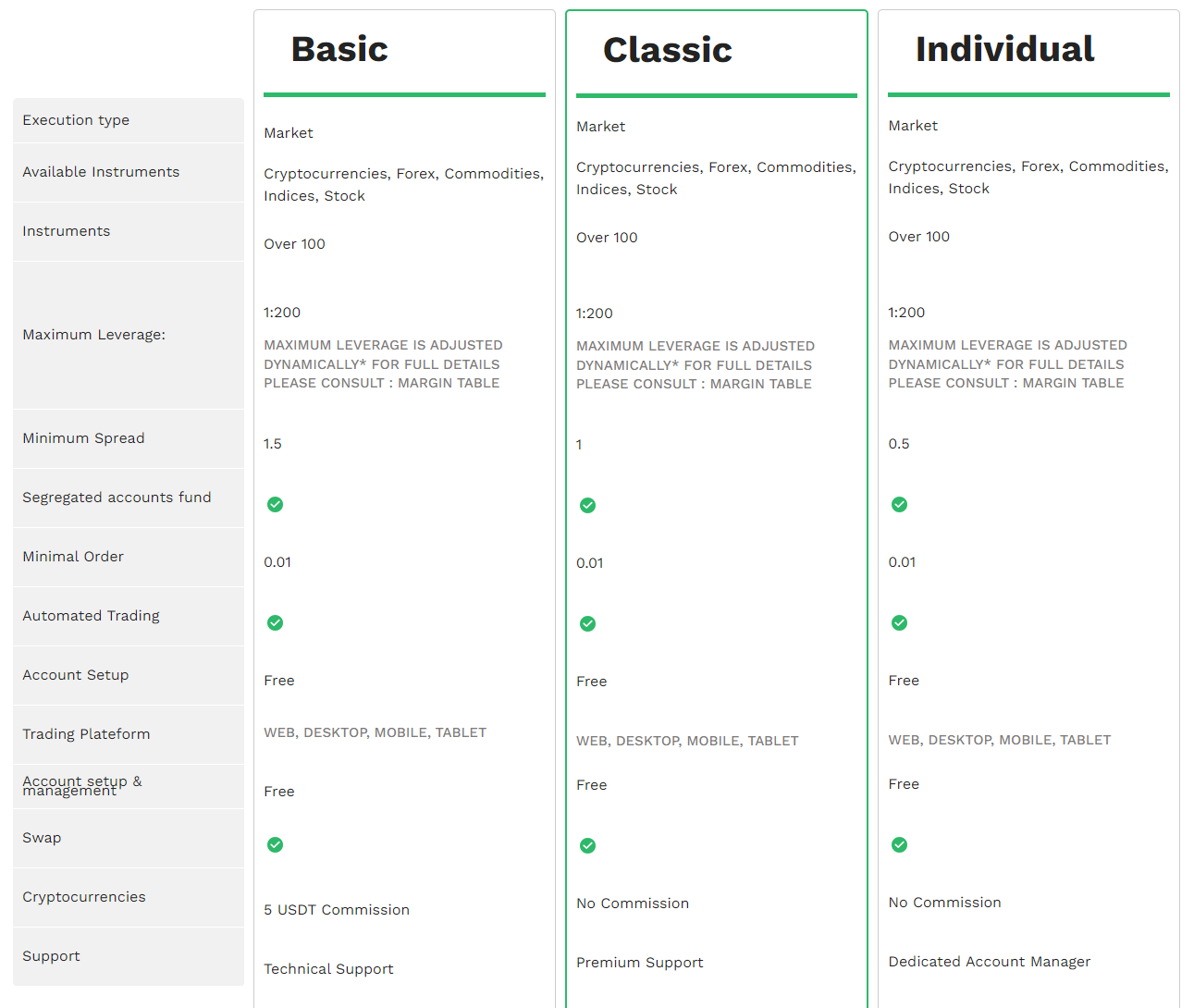

Basic, Classic and Individuals are the three accounts you can choose from with Ex-Cap, and we’re pretty sure that you will find the right account type for you. You need to be aware that margin requirements are dynamically adjusted based on the instruments you are trading.

Speaking of spreads, Ex-Cap offers more competitive quotes for large account holders. Spreads start from 1.5 pips with Basic accounts and drop to 0.5 pips with Individual accounts. You should also know that trading commissions are charged only with the Basic tier.

All customers working with Ex-Cap can trade via browser, desktop, mobile and tablet thanks to the flexible software employed by the broker. The interface is simple yet provides all the necessary resources to analyze price action developments.

Support

In terms of customer support, unregistered users can reach out to an agent using email or phone between 7 a.m. and 5 p.m. GMT. Traders holding an account with Ex-Cap receive technical support (Basic account), premium support (Classic account) and a dedicated account manager (Individual account).

Regardless of your account type, it does seem like the company is interested in making sure you get all of the assistance that you need to trade effectively. After all, the notion of CDI is relatively new and many traders are not familiar with the concept. Don’t worry, though, because this broker is here to help.

Ending thoughts

Ex-Cap offers attractive trading conditions on CDIs and it is also regulated as an international brokerage and clearing house by M.I.S.A. You should not underestimate the importance of a regulatory framework these days. Based on our analysis, it looks like the brand is worth trying out.